Gillingham is located in the Medway region of Kent and is a well-connected town, only around 30 minutes from London by train. It neighbours the towns of Chatham and Rochester and forms one of the biggest urban areas outside of London. It has a growing student and professional population and is home to around 110,000 people, and it is becoming increasingly popular with HMO investors.

We think Gillingham is a great place for HMO investors, whether you are investing for the first time or have a lot of experience. This is our complete guide to HMO investment in Gillingham.

Why invest in HMOs in Gillingham?

One of the many reasons that Gillingham is popular with HMO investors is that it is not covered by an Article 4 direction like many cities in the UK. This means that you are able to convert single-family homes (C3) to small HMOs (C4) under permitted development rights without the need to submit a planning application to the local council.

If you are an HMO investor, this is good news as it can reduce the risk of investing in HMOs significantly. Once a property has been converted to a 6 person HMO, it is then also possible to apply for a Sui Generis HMO for 7 or more occupants. Given that the property is already in active use as an HMO at that point, objections to Sui Generis planning like parking pressure or noise disturbance tend to carry less weight in the planning process.

This process of establishing a property under permitted development first and then applying for Sui Generis later making Gillingham a favourable area from a planning standpoint. It can offer HMO investors the flexibility and scalability that heavily regulated towns and cities lack.

Transport Links and Professional Demand

One of the benefits of Gillingham for tenants is the excellent rail connections into London. Fast trains can reach London St Pancras in under 45 minutes, and there are also direct services to London Victoria and Charing Cross. For commuters, this is a very convenient route and makes Gillingham an attractive location for young professionals – particularly for those priced out of the expensive London rental market.

Outside of the appeal to commuters, Gillingham has its own employment base including the Medway Maritime Hospital, one of the largest in Kent. It also has many business parks and educational institutions, contributing to a rental demand from key workers and students.

Housing Stock

One of my key considerations when it comes to assessing the viability of HMOs in a given location is the type and quantity of the existing housing stock.

Gillingham has a large number of Victorian and Edwardian terraced properties that are ideal for HMO conversion and they typically offer generous internal layouts, including things like reception rooms and decent sized bedrooms, all of which lend themselves to multi-occupancy setups. This isn’t something investors always think about, but it’s a big consideration as not all areas have properties such as these.

This type of housing is also relatively affordable compared to neighbouring areas closer to London, which can also improve return on investment and make refurbishment projects more viable.

Size Requirements and Shared Amenities

Another advantage of investing in HMOs in Gillingham is the flexibility around shared amenities and room sizes. Unlike some local authorities, Medway Council does not have very rigid room size requirements. In some instances, they may refer to Essex or national guidance as a benchmark. Read our article on national minimum room standards for HMOs to understand what these limits are.

In our experience, a combined shared spare of around 20 square metres is generally enough for six occupants, while 25-30 square metres is advisable for seven or more people. We always recommend engaging with the local housing standards team early in your planning process to help ensure you’re being compliant and avoid costly pitfalls.

Student Population

Gillingham is home to two universities – University of Greenwich and Canterbury Christ Church University. Both Medway campuses are part of the Universities at Medway Partnership, which shares facilities and attracts a diverse group of students to the Gillingham area.

While it doesn’t necessarily boast the same volume of students like the cities of Southampton and Bristol, there is still a very reliable and consistent level of demand for shared accommodation like HMOs. Student HMOs specifically tend to cluster around the campuses and town centre, and the competition is generally lower, meaning full occupancy and strong yields are easier to achieve.

HMO Licensing in Gillingham

As with the rest of the UK, Gillingham is subject to mandatory HMO licensing for any property that houses more than five tenants. You can read more about this on the Medway Council website. It’s important to remember that this applies regardless of whether a property is in an Article 4 area or not.

At the time of writing, there is currently no additional or selective licensing scheme in Gillingham or in the wider Medway area, therefore simplifying the process for HMO investors.

If you are planning to invest in an HMO with 5 or more tenants, you’re planning application will be submitted to Medway Council and landlords must ensure that their properties meet all the rules and requirements. You can find out more about HMO licensing requirements in our article.

Here are the HMO licensing fees in Medway:

HMO licence fees:

- £1,305.30: to licence a House in Multiple Occupation

- £1,305.30: to change a licence holder (you must complete a new application)

- £1,160.10: second or subsequent application

- £135.87: for licence changes such as a change of manager

- £730.07: to renew a licence with no significant changes

- £829.37: to renew a licence with significant changes

- £165.71: for a licence variation.

Other charges:

- £49.29: if you’re issued a second reminder letter for an HMO licence

- £211.11: for a fixed penalty notice for an unlicensed HMO

- £53.89: Register of Licences viewings.

Rental Yields and Investment Potential

HMO rental yields in Gillingham are typically strong in our experience, and particularly when compared to standard buy-to-let properties. It’s not a secret that HMOs can generate higher returns given the nature of renting out multiple rooms, and yields of between 8%-12% are not uncommon. Larger, well presenting HMOs with ensuites and high quality interior finishes tend to generate better returns.

The combination of steady demand, affordable properties and low planning friction mean that Gillingham is a compelling option for both experienced HMO investors and those looking to invest in their first HMO.

Best Areas to Invest in Gillingham

Based on all of the above, these are some of the areas we think are great to look at in terms of HMO investments in Gillingham.

Gillingham Town Centre & High Street

Best for: Professional and student HMOs

Houses in the town centre and high street benefit from close proximity to the train station, university campuses and local amenities. The town centre has a mixture of large Victorian properties and can be a very popular choice for students and young professionals.

Upper Gillingham

Best for: Larger professional HMOs

This part of the town has a lot of good quality family homes that have the potential for large scale conversions. Streets offer generous plots and high internal square footage, which can allow for additional ensuites and communal spaces.

Brompton & The Historic Dockyard Area

Best for: Niche or premium HMOs

This area is a bit quieter and has a more village-like environment, which may appeal more to mature tenants and professionals working at the hospital or elsewhere in the area. The housing tends to be older and more characterful, which can lend itself to high-end HMO conversions if done sympathetically.

Finding the Best HMO Investment Property in Gillingham

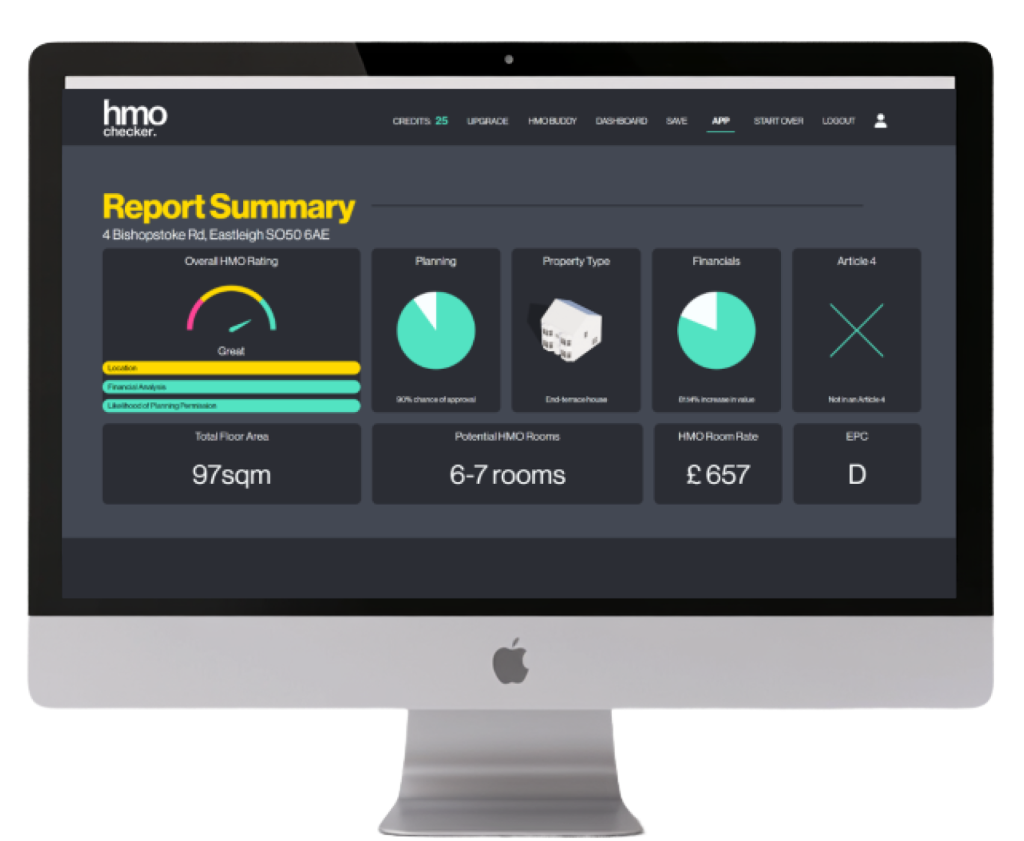

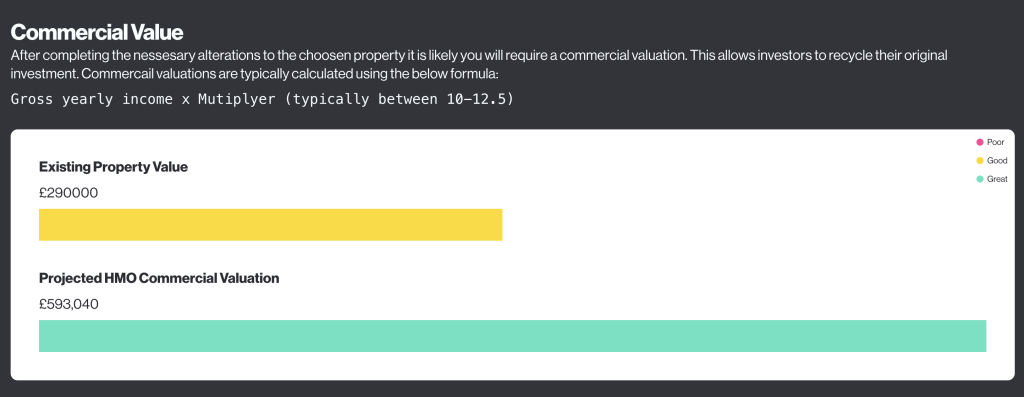

When assessing a potential HMO projects in Gillingham, we usually recommend researching the different areas, property types, rental yields and more. HMO Checker is a great tool that we use to analyse different potential investment properties against a number of criteria.

While Gillingham is not in an Article 4 area, HMO Checker still enables us to check other important planning and investment factors such as:

- Comparable planning approvals for large HMOs

- Local rental data and yield estimates

- House density

- Nearby amenities and universities

If you sign up you’ll get two free credits to check 2 properties without any credit card information. We recommend giving it a try, as many investors have found it incredibly helpful in facilitating their HMO investment projects. Give it a go >

Gillingham HMO Project Example

Caroline and Andre used HMO Checker to identify and analyse their latest property investment, located in Gillingham, Kent. What started as a promising 7- bedroom HMO exceeded expectations, becoming an 8-bedroom high- end HMO targeting professionals.

Key insights from the report:

- Planning Likelihood: 60% (Good)

- Financial Potential: Predicted 60% increase in property value

- HMO Density: 8% within a 50m radius

- Local Market: Average room rate of £706/month (actual rates now expected between £780-£850/month for this project)

- Property Size: 109m², with potential for extensions

- Proposed Layout: Optimised for 7 rooms (later extended to 8)

“This project has taken us to a new investment area which we are excited about and the development we hope will be the first on many in the area. We are really excited to see the final product and look forward to working with the team again to hopefully replicate the opportunity, results and quality of finished project to the area.” – Caroline & Andre

Read about the full project and see the site visit >

Final Takeaways from HMO Investment in Gillingham

To wrap up, Gillingham presents a strong, low-barrier opportunity for HMO investment in the southeast. Here are some final points to consider:

- No Article 4 direction means fewer planning restrictions and reduced risk.

Excellent transport links make it attractive to professionals working in both Kent and London. - Good-quality Victorian housing stock provides an ideal base for conversion into multi-occupancy homes.

- Strong rental yields and growing demand from professionals and students alike underpin consistent returns.

- Minimal licensing complexity compared to other local authorities.

If you’re considering launching or expanding your HMO portfolio in Gillingham and would like a feasibility assessment, planning support, or help sourcing the right property, feel free to get in touch.